Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Sensor Markets, Technologies, Companies 2024-2044: By Inputs, Modes, Applications, Patents, Manufacturers, Research, Roadmaps, Forecasts

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

PDF Download Report

Single User License - Allowing one user access to the product.

Site License - Allowing all users within a given geographical location of your organisation access to the product.

Enterprise License - Allowing all employess within your organisation access to the product.

Contents List

-

1.1 Purpose of this report

1.2 Scope of this report

1.3 Why precision is impossible

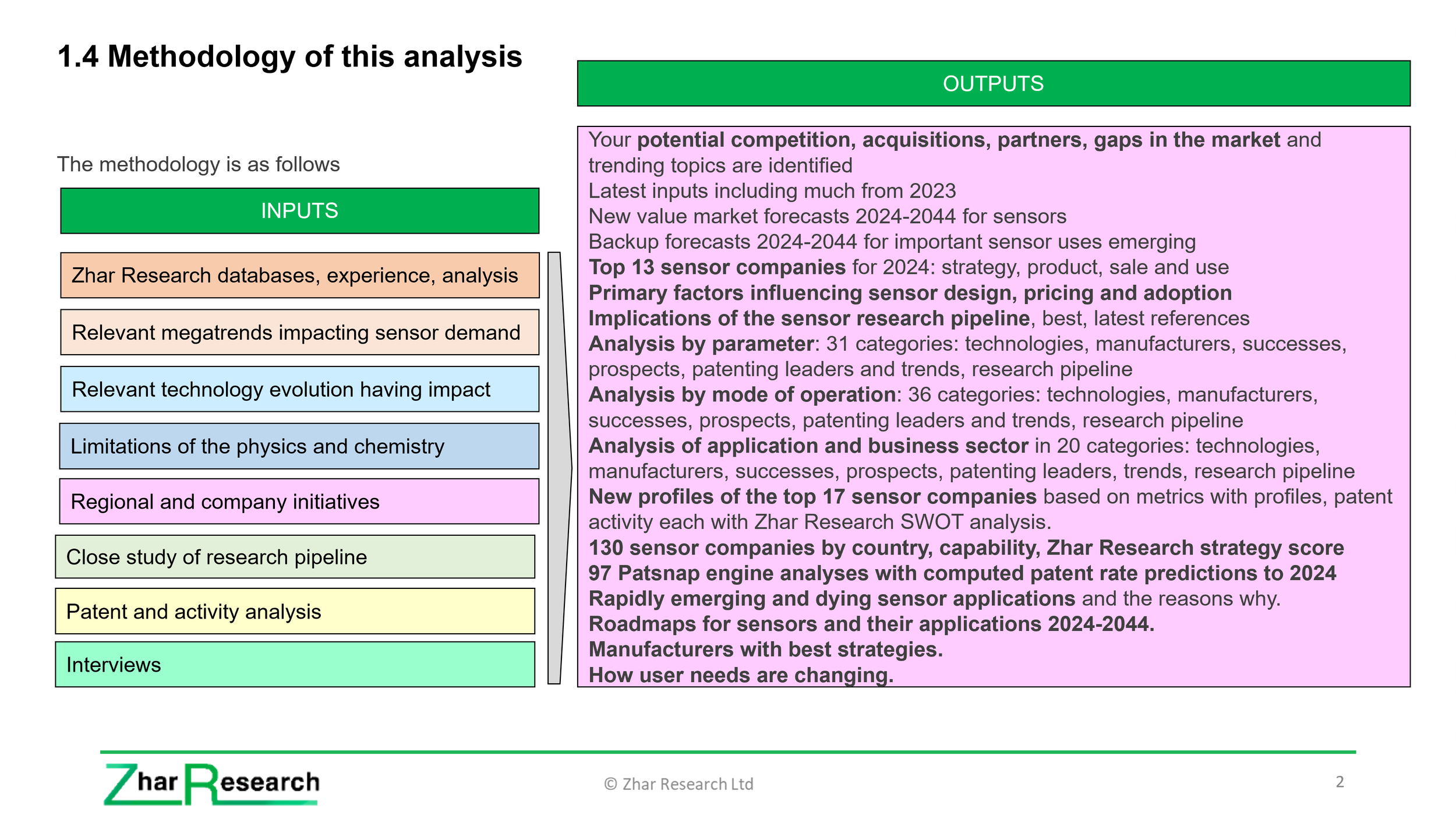

1.4 Methodology of this analysis

1.5 19 primary conclusions

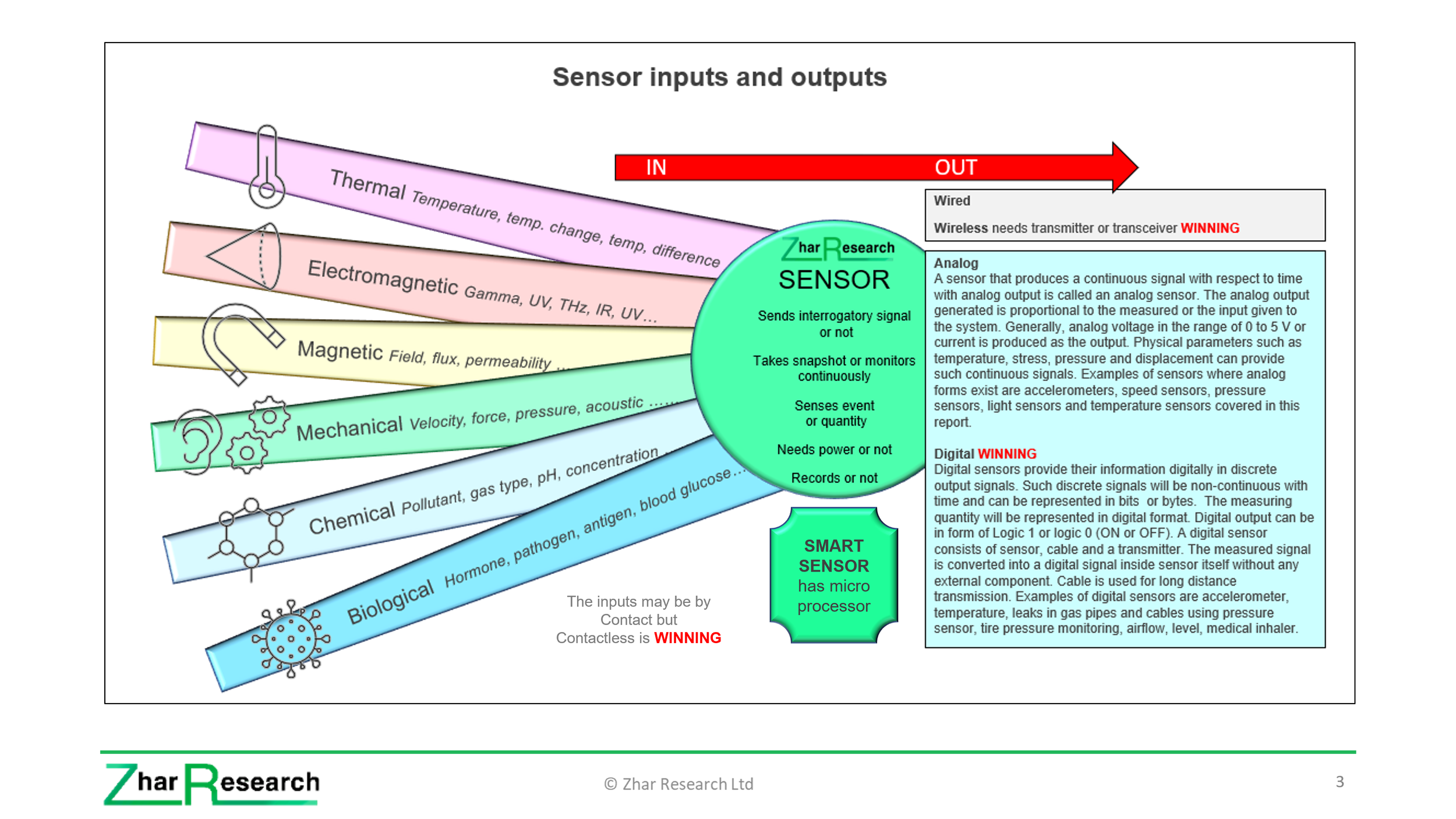

1.6 Sensor basics: biomimetics, inputs, outputs, smart sensors

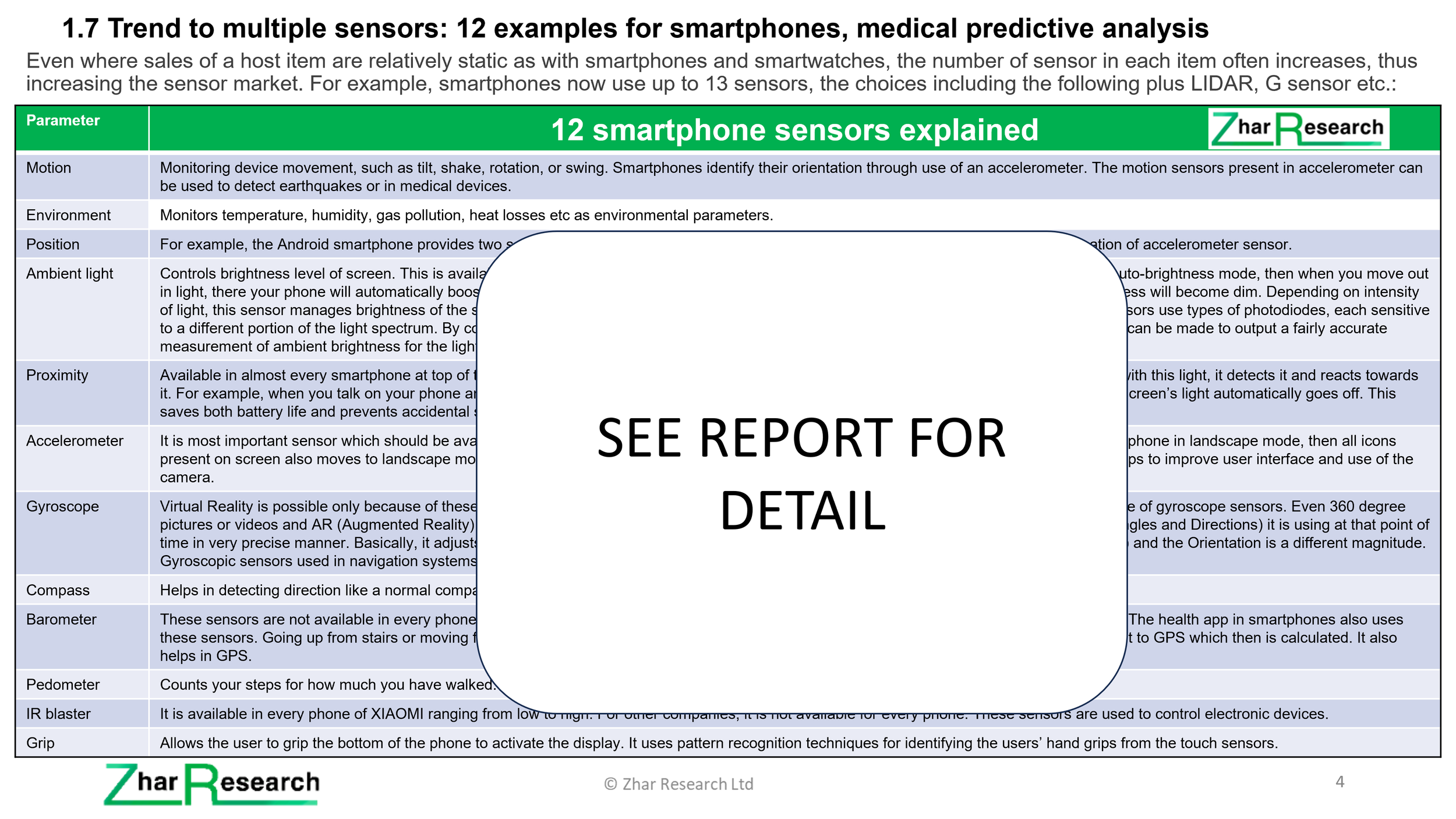

1.7 Trend to multiple sensors: 12 examples for smartphones, medical predictive analysis

1.8 Look beyond the tip of the iceberg: catalog sensor vendors are only the tip

1.9 Sensor business infogram

1.10 Sensor market drivers by sector 2024-2044

1.11 Light sensing dominates

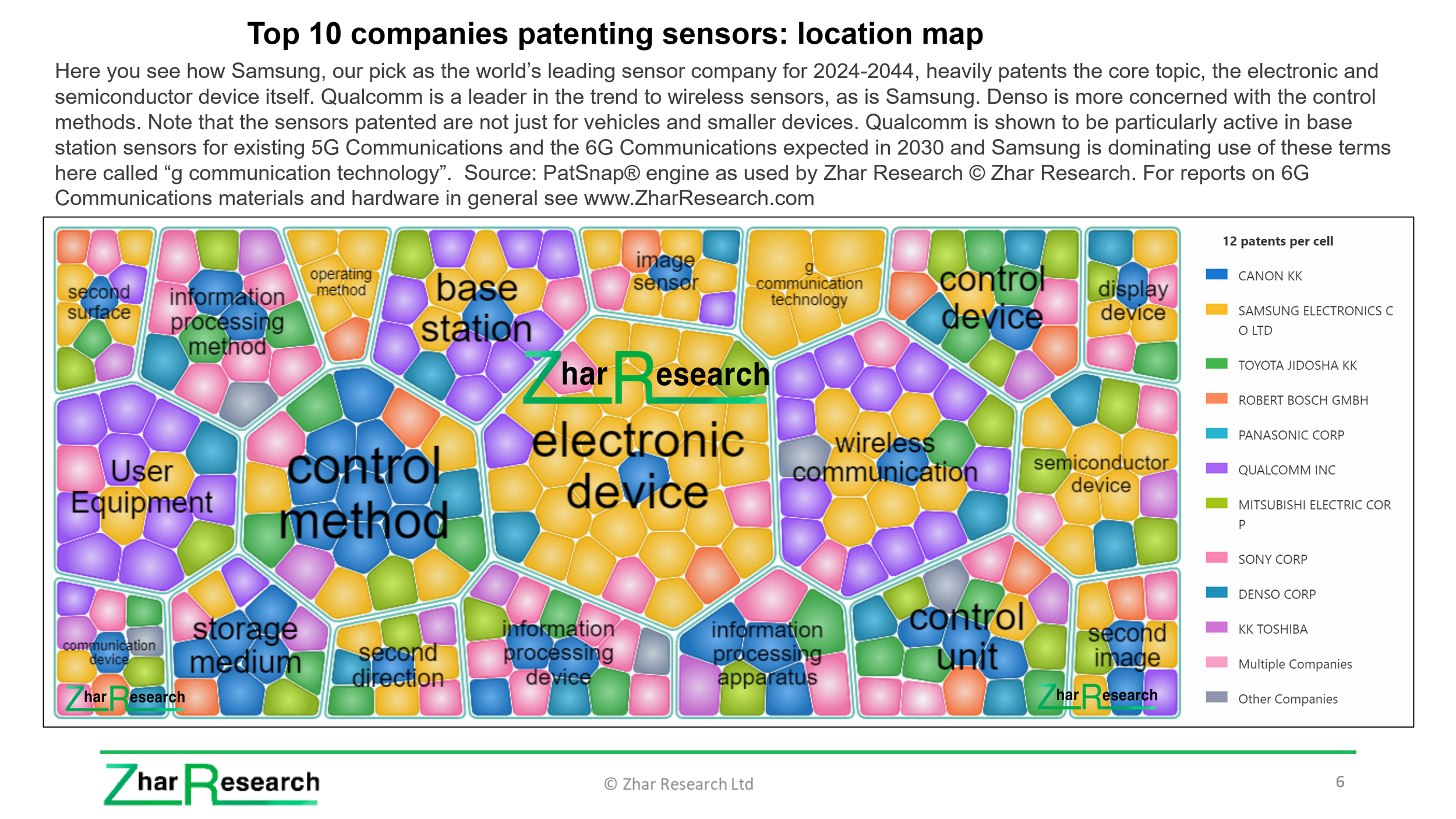

1.12 Establishing the leading sensor companies for 2024-2044 with leader SWOT

1.13 Market forecasts in 48 lines

1.13.1 Methodology and reality checks

1.13.2 Market growth rate

1.13.3 Sensor location hardware market $ billion 2024

1.13.4 Sensors global value market for seven application sectors $ billion 2023-2044: table

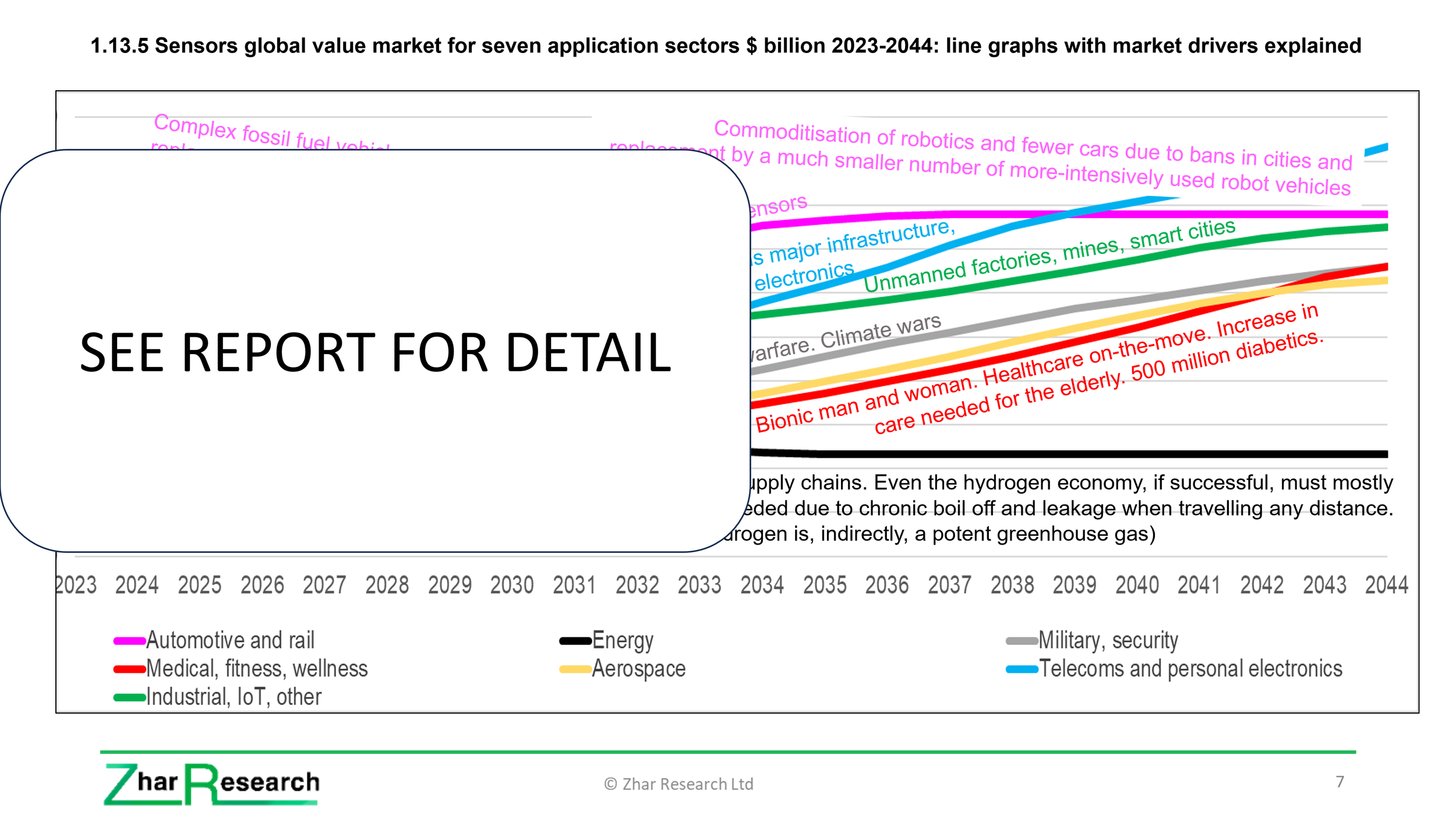

1.13.5 Sensors global value market for seven application sectors $ billion 2023-2044: line graphs with market drivers explained

1.13.6 Sensors global value market for seven application sectors $ billion 2023-2044: area graph

1.13.7 Global total sensor hardware market $ billion 2024 with linear average

1.13.8 Sensor value market % by 6 input media 2024, 2034, 2044: table with sub-categories and reasons

1.13.9 Sensor value market % by six input media 2024-2044: graphs

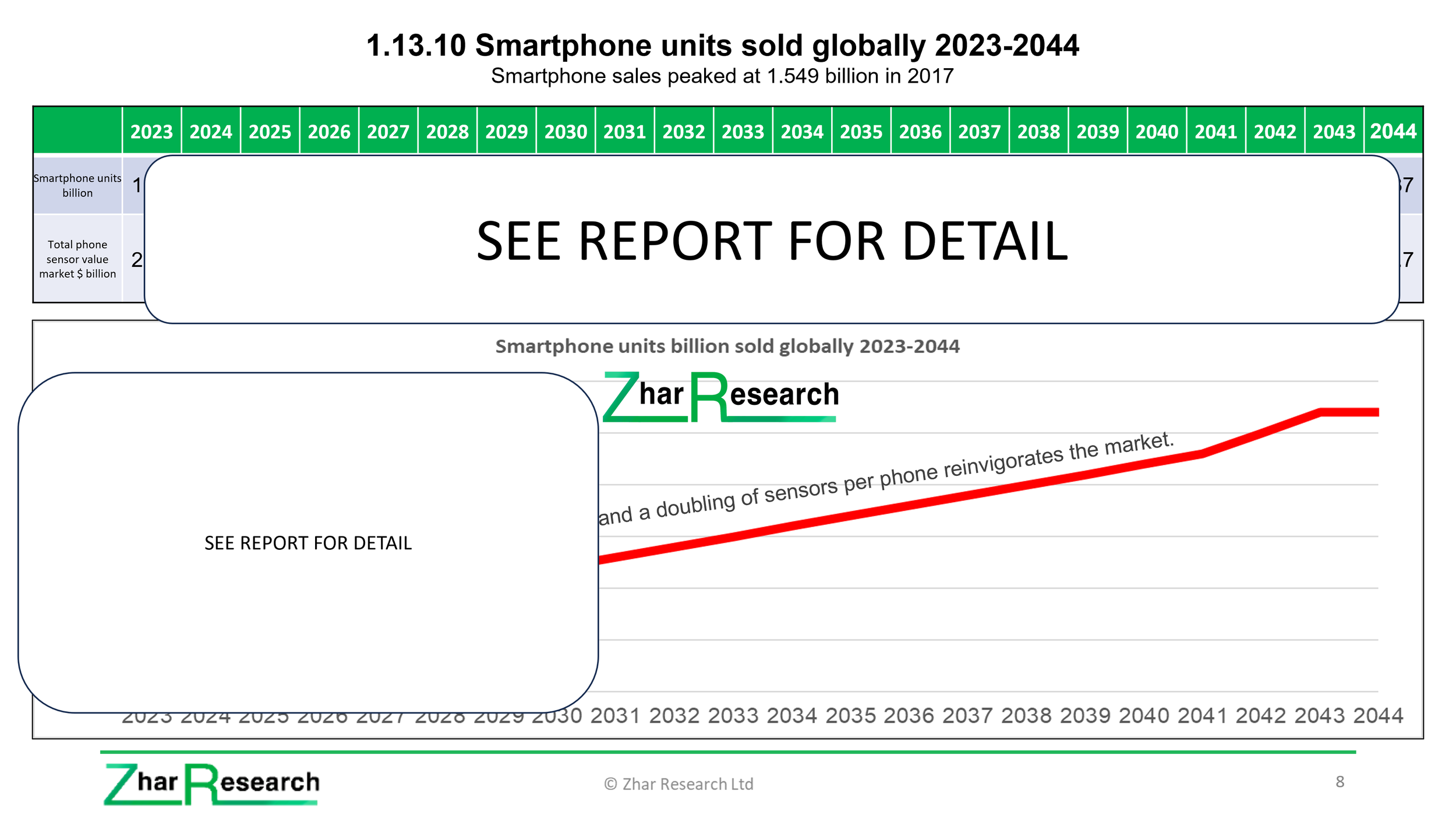

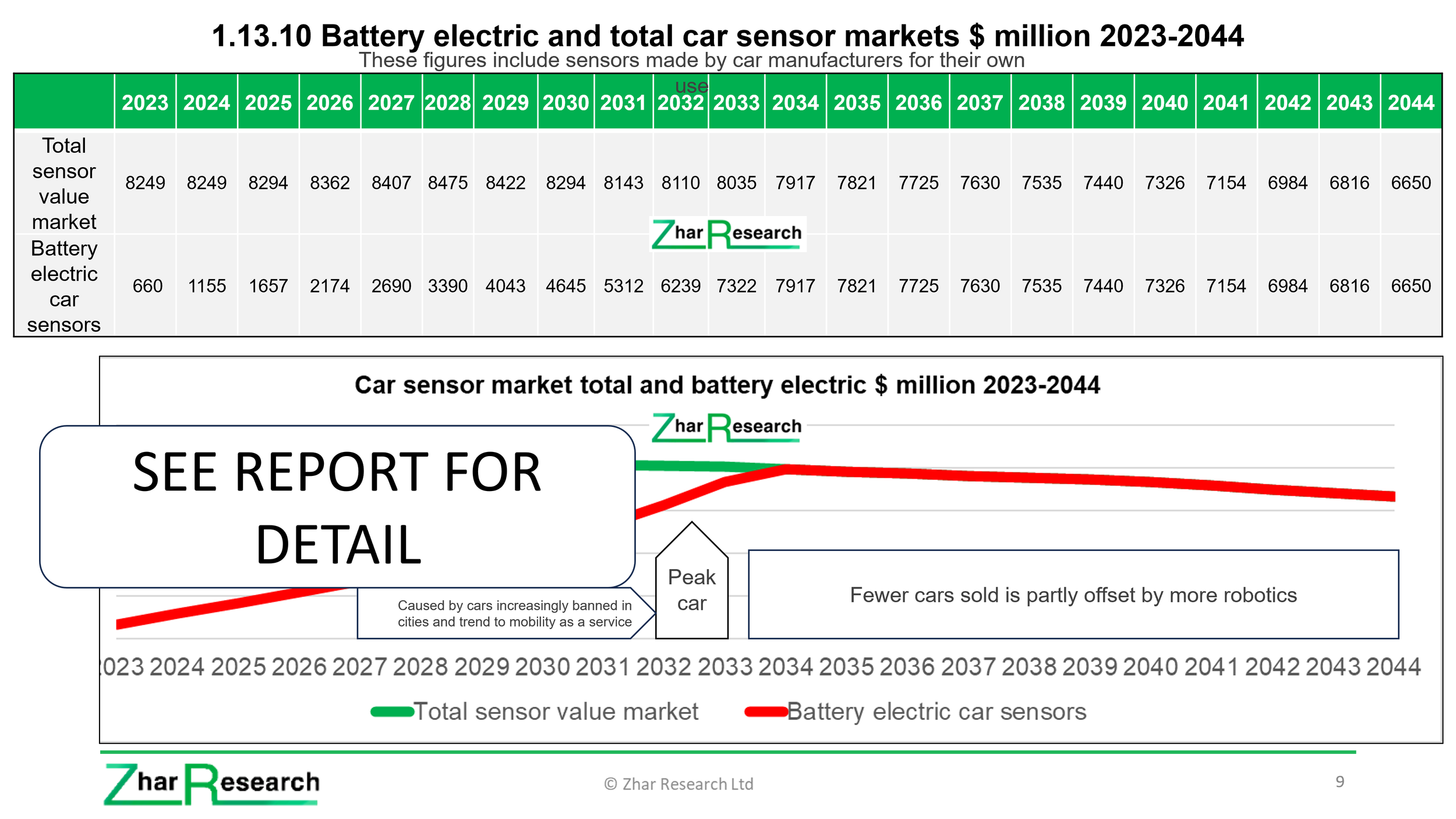

1.13.10 Smartphones and their sensor market units, unit price, value market $ billion 2023-2044

1.13.11 Rapidly emerging sensor market: Active cooling market forecasts in eight categories $ billion 2023-2043

1.13.12 New sensor market: Long Duration Energy Storage LDES market by 11 primary technology applications and new market needs 2023-2043

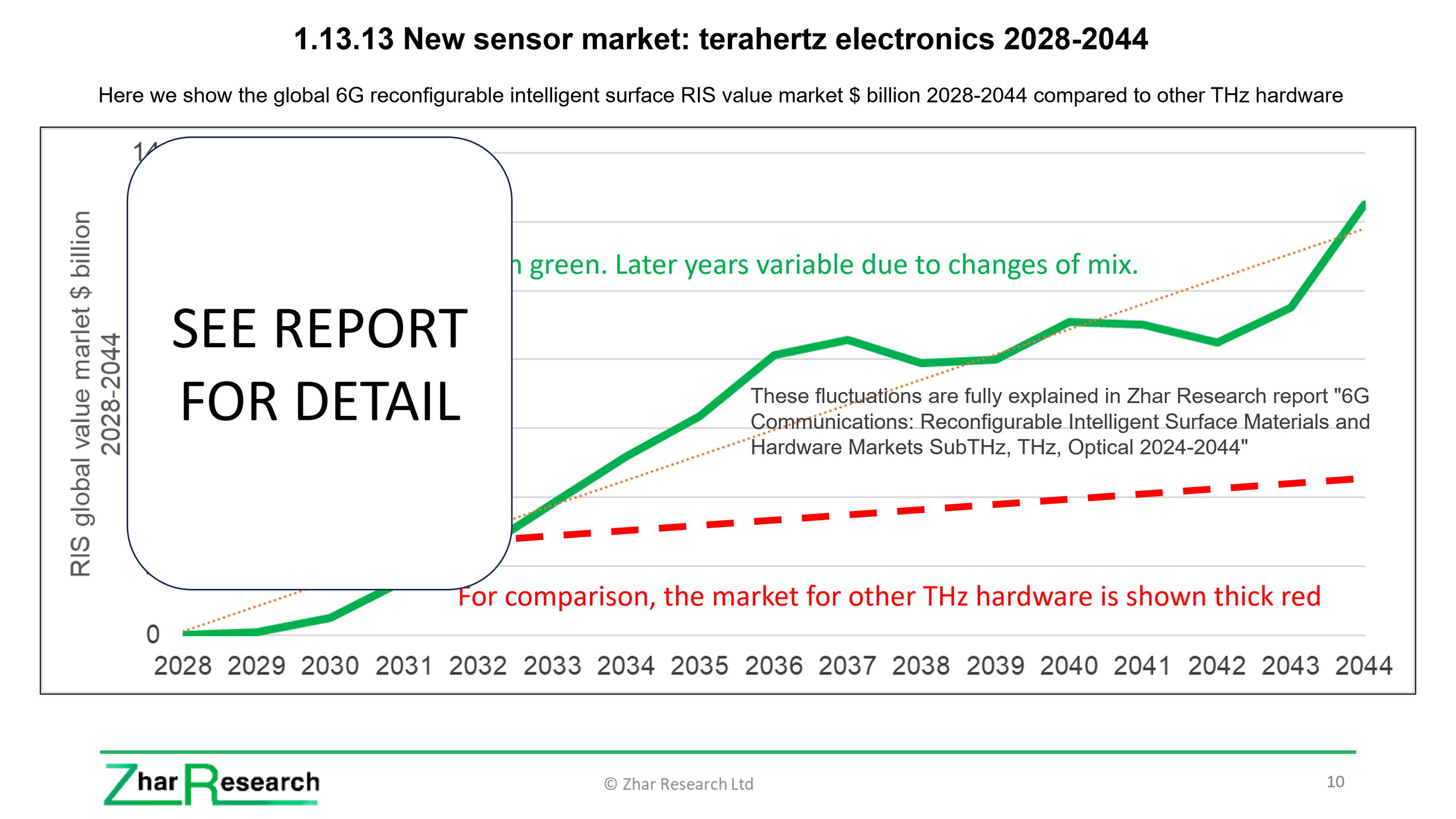

1.13.13 New sensor market: Terahertz electronics 2028-2044

1.14 Sensor roadmap 2024-2044

-

2.1. Definition and design

2.2. Categories

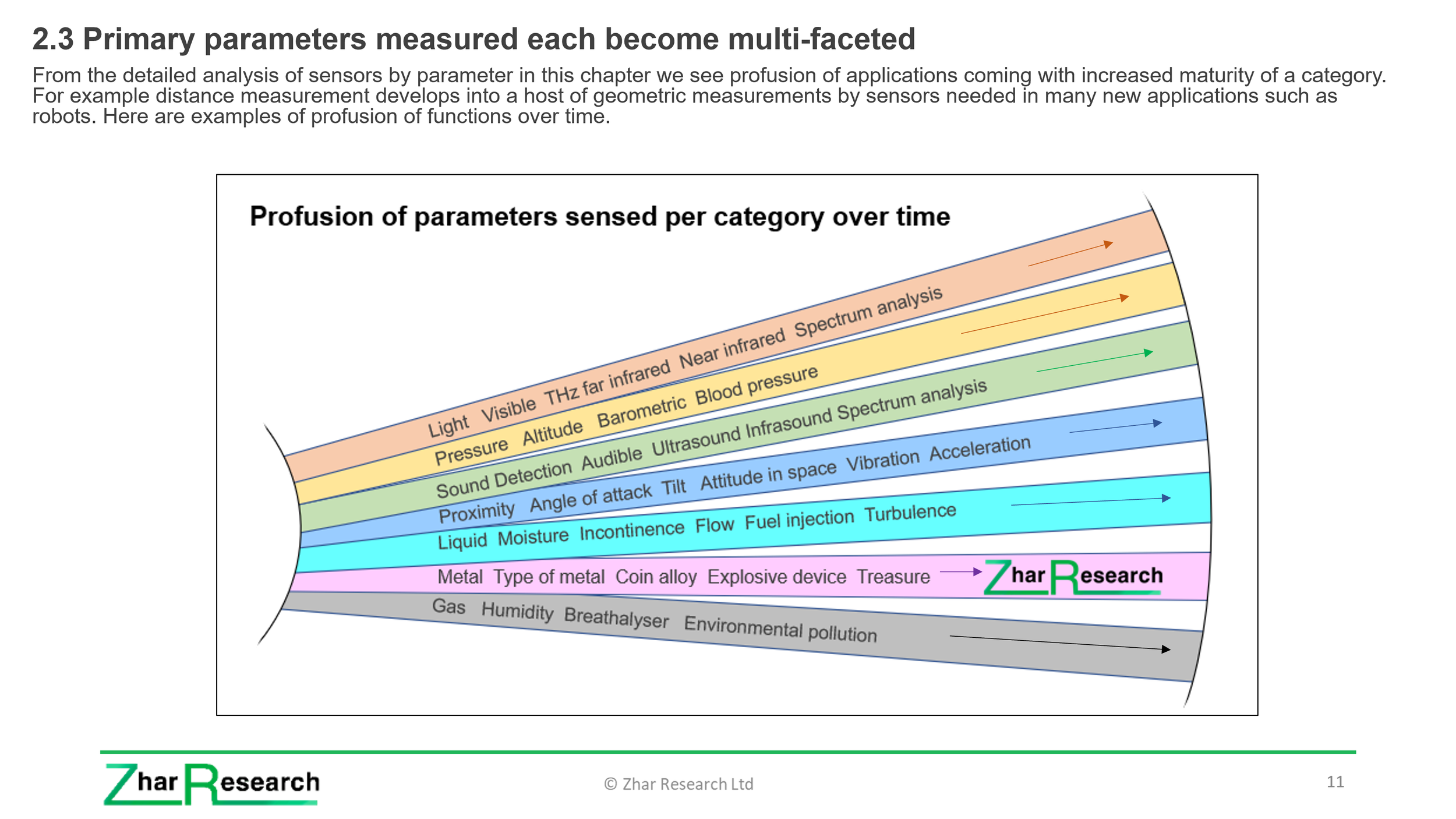

2.3. Primary parameters measured each become multi-faced

2.4. Megatrends driving sensor adoption

2.5. Sensor usefulness

2.6. Demand trends

-

3.1. Definitions, inputs, anatomy, outputs

3.2. Smart sensor anatomy and purpose

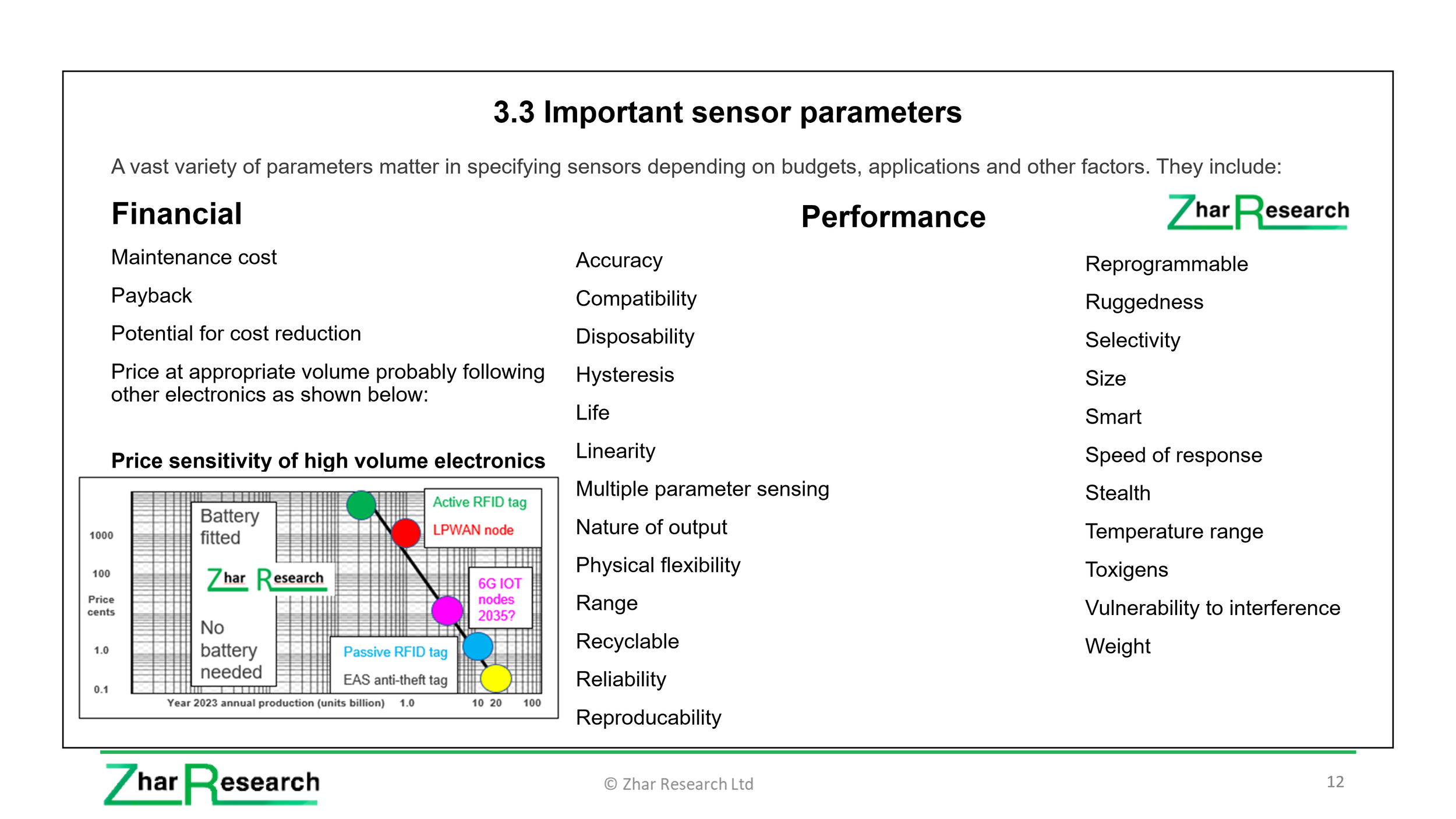

3.3. Important sensor parameters

3.4. Why light sensing will dominate 2024-2044

3.5. Sensor trend from search of 3.7 million patents

3.6. Look beyond the tip of the iceberg: catalog sensor vendors are only the tip

3.7. The size challenge and significance of energy harvesting

3.8. Trend to multiple sensors: 12 examples for smartphones, medical predictive analysis

3.9. Biomimetics: skin sensors, self-healing sensors and sensor fusion

3.9.1. Skin sensors and self-healing

3.9.2. Sensor fusion

3.9.3. Printed sensors

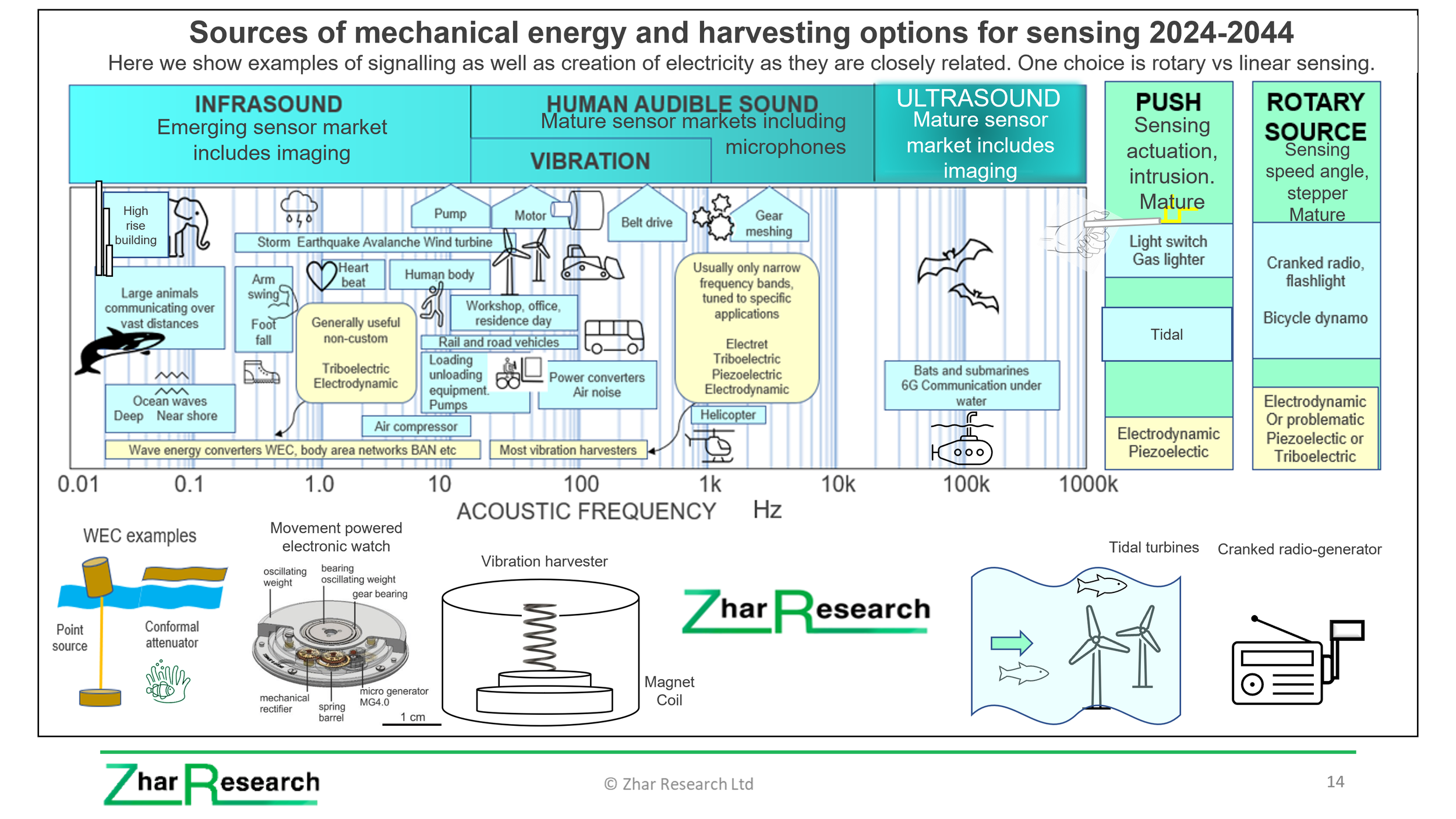

3.10. Importance of energy harvesting as on-board power and in reverse as forms of sensor

3.10.1. Overview

3.10.2. Mechanical (electrodynamic and acoustic) harvesting including acoustic in detail

3.10.3. Sources of electromagnetic sensing targets and sensor power options 2023-2043

3.10.4. Patenting self-powered sensors using energy harvesting modes or separate harvester modules

3.10.5. Importance of flexible laminar energy harvesting and sensing 2023-2043

3.11. Shrinking the market for sensors – host system and vehicle simplification

-

4.1. Overview

4.2. Acoustic (sound) sensors

4.3. Alcohol sensors

4.4. Altitude sensors

4.5. Angle-of-attack sensors

4.6. Attitude sensors

4.7. Blood glucose sensors

4.8. Blood oxygen sensors

4.9. CGM continuous glucose monitoring sensors

4.10. Chemical sensors

4.11. Colour sensors

4.12. Distance sensors

4.13. Flow sensors

4.14. Force sensors

4.15. Fuel injection sensors

4.16. Humidity sensors

4.17. Incontinence sensors

4.18. Image sensors

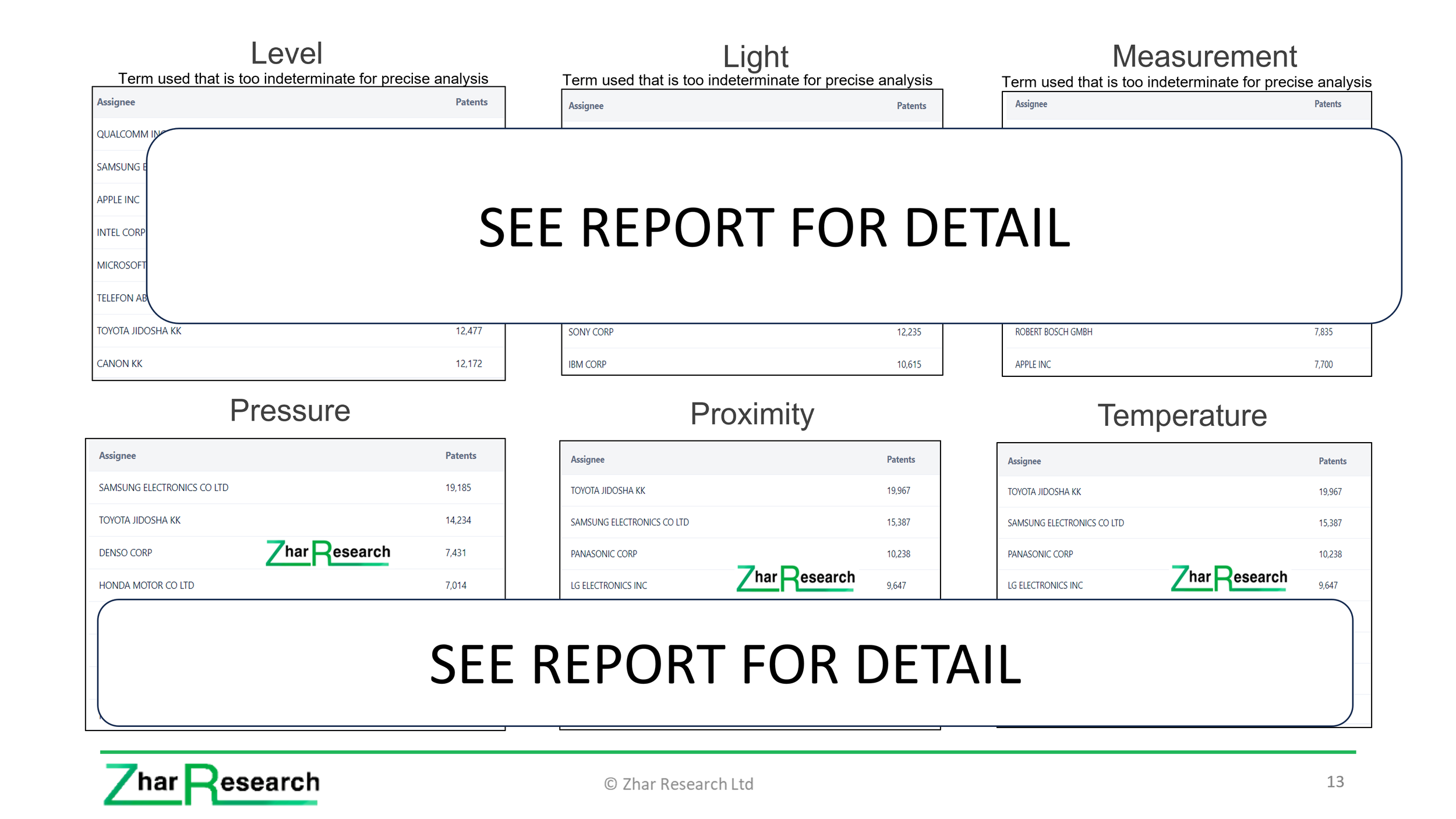

4.19. Level sensors

4.20. Light sensors

4.21. Measurement sensors

4.22. Metal sensors

4.23. Moisture sensors

4.24. Motion sensors

4.25. Position sensors

4.26. Pressure and strain sensors

4.27. Proximity sensors

4.28. Temperature sensors

4.29. Tilt sensors

4.30. Touch sensors

4.31. Vibration sensors

4.32. Weight sensors

-

5.1. Overview

5.2. Acceleration sensors and accelerometers

5.3. Barometric sensors

5.4. Biosensors

5.5. Camera sensors

5.6. Capacitive sensors

5.7. CMOS and MOS sensors

5.8. Electrochemical sensors

5.9. Electrodynamic sensors

5.10. Electro-optic sensors

5.11. Electrostatic sensors

5.12. Fiber optic and THz waveguide sensors

5.13. Gyroscope sensors

5.14. Hall effect sensors

5.15. Inducive sensors

5.16. Infrared sensors

5.17. Infrasound sensors

5.18. LIDAR sensors

5.19. Magnetometer sensors

5.20. MEMS sensors

5.21. Optical sensors including biometric optoelectronic memtransistors

5.22. Photoelectric sensors

5.23. Photonic sensors

5.24. Photovoltaic sensors

5.25. Piezoelectric sensors

5.26. Piezoresistive sensors

5.27. Piezotronic sensors

5.28. Quantum sensors

5.29. RADAR sensors

5.30. Thermistor sensor

5.31. Thermoelectric sensors

5.32. Triboelectric sensors

5.33. Ultrasound sensors

-

6.1. Overview

6.2. Automotive including engine and traction motor sensors

6.2.1. Automotive sensors

6.2.2. Engine sensors

6.2.3. Traction motor sensors

6.3. Environmental, mining, pathogen and gas sensors

6.3.1. Environmental

6.3.2. Pathogen sensors

6.3.3. Mining

6.3.4. Gas sensors

6.4. Industrial including IoT sensors

6.4.1. Industrial sensors

6.4.2. IoT sensors

6.4.3. Logistics sensors

6.5. Medical, fitness, wellness sensors

6.5.1. Medical sensors

6.5.2. Heart sensors

6.5.3. Nerve sensors

6.5.4. Healthcare sensors

6.5.5. Fitness sensors

6.5.6. Exercise sensors

6.6. Telecommunications and personal electronics

6.6.1. 6G Communications sensors

6.6.2. Smartphone sensors

6.6.3. Smartwatch sensors

6.7. Wearable sensors

-

7.1. Overview

7.2. Apple strategy, patent trends, forecasts, sensor SWOT

7.3. Canon strategy, patent trends, forecasts sensor SWOT

7.4. Denso strategy, patent trends, forecasts sensor SWOT

7.5. F. Hoffmann La Roche strategy, patent trends, forecasts sensor SWOT

7.6. Medtronic strategy, patent trends, forecasts sensor SWOT

7.7. Mitsubishi strategy, patent trends, forecasts sensor SWOT

7.8. Panasonic strategy, patent trends, forecasts sensor SWOT

7.9. Qualcomm strategy, patent trends, forecasts sensor SWOT

7.10. Robert Bosch strategy, patent trends, forecasts sensor SWOT

7.11. Samsung strategy, patent trends, forecasts sensor SWOT

7.12. Sensata Technologies strategy, patent trends, forecasts sensor SWOT

7.13. Sony strategy, patent trends, forecasts sensor SWOT

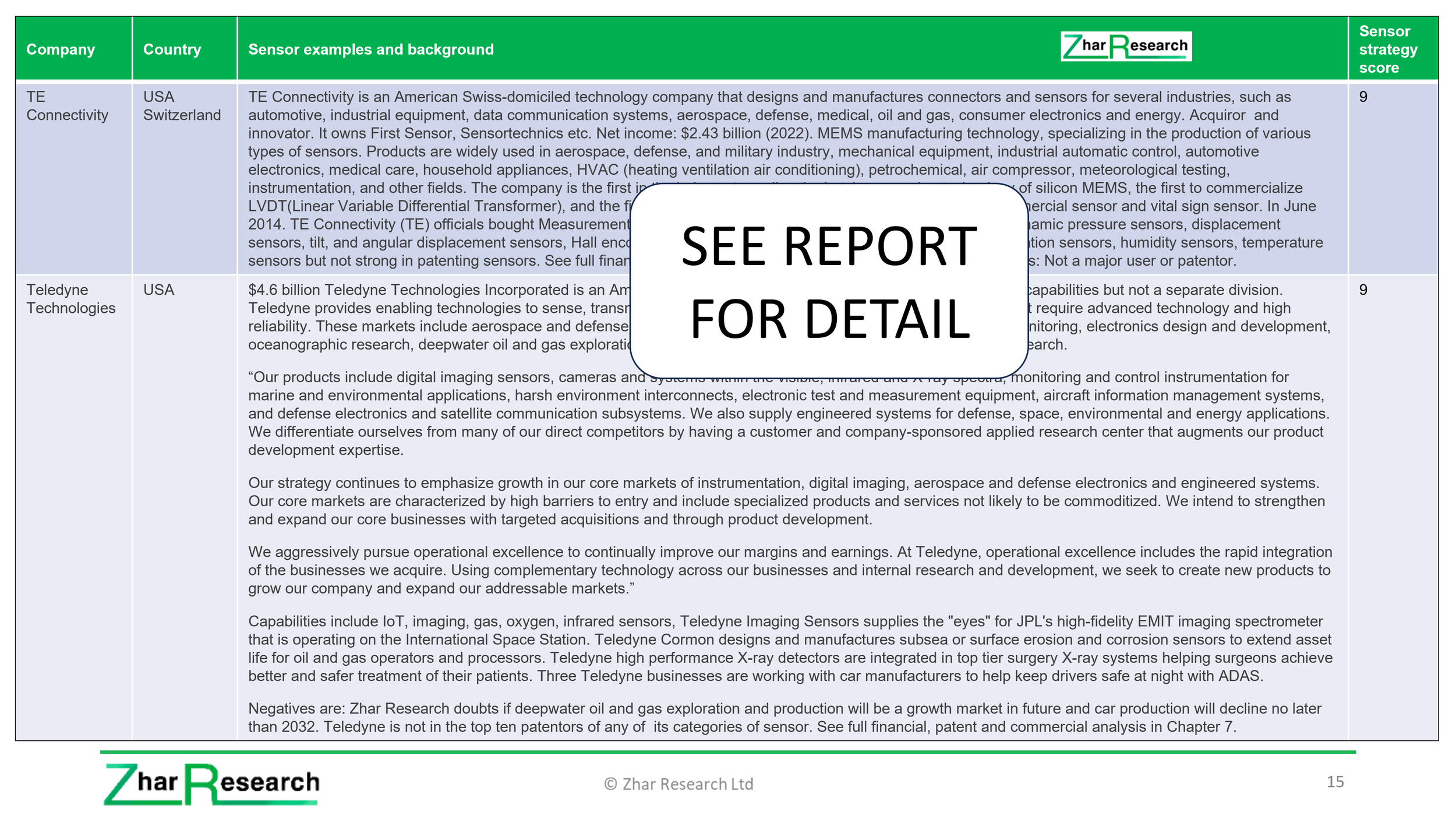

7.14. TE Connectivity strategy, patent trends, forecasts sensor SWOT

7.15. Teledyne Technologies strategy, patent trends, forecasts sensor SWOT

7.16. Toshiba strategy, patent trends, forecasts sensor SWOT

7.17. Toyota strategy, patent trends, forecasts sensor SWOT

-

8.1. Overview

8.2. 130 company table comparison by company, examples, background and Zhar Research strategy score

8 chapters

17 SWOT appraisals

20 analyses by business

31 analyses by parameter

36 analyses by operation mode

48 forecast lines 2024-2044

97 PatSnap ® engine analyses

3.7 million patents searched for trends

200+ companies mentioned, most compared

417 pages

New Sensor Report Reflects New Realities

It is uniquely affordable, comprehensive and up-to-date. The new, 417-page Zhar Research report, “Sensor markets, technologies, leaders 2024-2044: by inputs, modes, applications, patents, manufacturers, research, roadmaps, forecasts” is now available. Its focus is commercial opportunities and potential partners, acquisitions and competitors. It even identifies several, totally new, large sensor markets ahead.

See the big picture – miss nothing

Dr Peter Harrop CEO of Zhar Research says, “Your opportunities are probably broader than you realise, whether your interest is as a manufacturer, integrator or user. We therefore recommend that you look at this full coverage before dipping into the many excellent reports on specifics. We see the total sensor hardware market approaching $250 billion in twenty years but within that there is an increasingly rapid change with some sectors declining and some growing very rapidly, supported by the many remarkable research advances in 2023. For example, sensors for conventional vehicles, conventional electricity production and fuel supply chains will mostly decline over twenty years.”

He adds, “The flood of patenting of LIDAR sensors was misleading because the biggest envisaged application in driverless cars is now doubtful as we warned years ago. Tesla is pulling ahead without it and, in 2023, Bosch exited LIDAR despite being a leading patentor at the time. In contrast, the advent of drone warfare, over 500 million diabetics, 6G Communications, cooling reinvented and massive, long duration grid storage are just some of the huge sensor growth opportunities that we analyse, many completely new. They kick in at various times over the coming twenty years. Looking at it another way, optical sensing, notably at infrared and visible wavelengths has a fabulous future across most applicational sectors for reasons we detail. They include the new THz far-infrared electronics, unmanned mining, factories and vehicles and much more”

Leading sensor companies beyond catalog sellers

Catalog sensor suppliers are the tip of the iceberg because most of the investment, patenting and value sale of sensors is by giant companies selling custom sensors both to others and to themselves. On multiple strategy and achievement criteria, the report identifies and examines the 2024-2044 sensor leader, 11 in the second division and 15 in the third division estimating their sensor sales. This is backed by detail and a strategy score for 130 companies for you to consider as acquisitions, partners or suppliers. Indeed, over 200 sensor manufacturers are mentioned throughout the report. A profusion of new infograms, comparison tables, graphs and images make the report both original and readable.

Chapter 1: Executive summary and conclusions is 45 pages sufficient in themselves. After purpose, scope and methodology you see 19 primary conclusions, based on the latest situation through 2023. There follows sensor basics, trend to multiple sensors with 12 examples for smartphones, a number set to double but already including medical predictive analysis. Learn the industry structure, with a new infogram. Sensor market drivers by sector 2024-2044 are presented, with why light sensing dominates and a new SWOT appraisal of the leader’s sensor prospects 2024-2044. Market forecasts in are shown in 48 lines with tables, graphs and including valuation of important new markets for sensors that are emerging in these years. Then comes a detailed new 2024-2044 sensor roadmap.

Chapter 2 Introduction uses eight pages to explain basic sensor design, inputs, categories, pricing issues, and the megatrends now driving sensor adoption. See why more sensors per device will often be more important to you than any increase in device sales.

Chapter 3 concerns primary factors now influencing sensor design, pricing and adoption. Its 40 pages closely examine definitions, inputs, anatomy, outputs, biomimetic and smart sensing, important sensor parameters, which sensing input will dominate 2024-2044. Also see the latest sensor trend from a new search of 3.7 million patents, the 12 most-patented sensors in common parlance and the top patentors in each case. In this chapter you also learn the size challenge with many examples and how multiple sensors, increasingly in one device, serve predictive analysis and sensor fusion. See 14 smartphone sensor families and why the number per phone will double. Understand skin sensors and self-healing sensors. Realise the importance of energy harvesting as on-board power and in reverse as forms of self-powered sensor input with great detail. Electrification is covered in the dramatically simpler electricity production and vehicle design that will collapse demand for many sensors.

Chapters 4 through 6 interprets, by parameter, the latest technologies, manufacturers, successes, prospects, patenting leaders and trends plus the research pipeline with best further reading including much from 2023. There are many new illustrations and informed comments throughout.

Chapter 4 covers latest analysis by parameter measured in 31 categories over 86 information-packed pages with illustrated examples, implications of research papers, patenting, patentors, products on sale, market drivers. Which have collapsing metrics, which are bursting on the scene and why? It is all here in data-based analysis.

Chapter 5 is a new analysis by mode of operation in 36 categories over 87 pages. That includes the new THz waveguide, infrasound, optical memtransistor, piezotronic, quantum and triboelectric sensors and other innovations that can boost your business.

Chapter 6 has analysis by application and business sector in 20 categories and 42 pages. That includes newly important sectors such as sensors for 6G telecommunications, electric vehicle traction motors and Internet of Things nodes each with their sensor patent trends, including forecasts of patenting to 2024, analysis and business appraisal. Other aspects are examination of common-parlance terms medical, healthcare, heart, exercise and fitness sensors each revealed by listing leading patentors, future prospects and research.

Chapter 7 presents in detail what Zhar Research finds to be the top 16 sensor companies with their 17 SWOT analyses, financials, profiles, sensor patent emphasis maps etc.

Finally, Chapter 8. Is called “130 sensor companies compared by country, capability, Zhar Research strategy score”. In 29 pages, it includes all the leaders identified earlier by both grouped multiple criteria, simply by patenting rate and it adds a deliberately varied mix of very small to very large other players to give a good understanding of the overall sensor business which runs to around 1000 companies. This chapter is structured as a two-page overview mentioning several other companies then a long table of the 130 chosen sensor companies with columns for company name, country, sensors examples with background and Zhar Research strategy score out of ten based on the scope of sensors made and used plus financial, market and technical positioning in the light of which markets we see growing and which collapsing 2024-2044.

With clarity the emphasis, Zhar Research report , “Sensor markets, technologies, leaders 2024-2044: by inputs, modes, applications, patents, manufacturers, research, roadmaps, forecasts” has a Glossary but also terms explained through the text. There are a large number of latest research papers recommended throughout for those wishing to dig deeper on specifics.